Measuring Financial Literacy Among the Students of Professional Courses

##plugins.themes.academic_pro.article.main##

Abstract

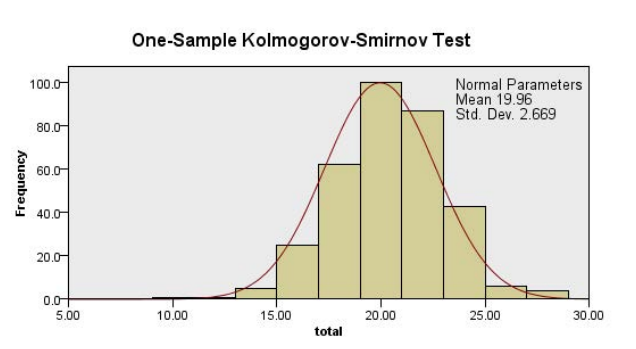

Individuals must acquire the skills required to live in today’s society and to deal with the growing variety and complexity of financial goods and services available because of the dynamic environment, fast-developing, internationally connected, and complicated financial markets. Finance becomes ever more complicated as technology advances and society grows. It is critical for colleges and universities students to graduate with a solid understanding of financial matters. The research aims to identify the level of financial literacy among students in Delhi NCR. Further, the paper also compared financial literacy among students in Delhi NCR based on different demographic. Both the primary as well as secondary data are used in the analysis. The primary data was obtained through an online questionnaire. The target group of the research study was students studying in India’s Delhi NCR colleges and universities and belonging to the courses MBA, BBA, M.Com, B.Com. The questionnaire was filled out by 335 respondents of Delhi NCR college students. The study concluded that at higher education institutions, there is no substantial significant difference in financial literacy between males and females

##plugins.themes.academic_pro.article.details##

References

- Atkinson, A., and Messy, F. A. (2012). Measuring financial literacy: Results of the OECD/International network on financial education (INFE) pilot study.

- Bashir, T. et. al. (2013). Investment preferences and risk level: Behavior of salaried individuals, IOSR Journal of Business and Management, 10(1), 68-78.

- Beal, D., and Delpachitra, S. (2003). Financial literacy among Australian university students. Economic Papers: A journal of applied economics and policy, 22(1), 65-78.

- Bhabha, J. I. et. al. (2014). Impact of financial literacy on saving-investment behavior of working women in the developing countries. Research Journal of Finance and Accounting, 13(5), 118-122.

- Chhillar, N., and Arora, S. (2020). Basic financial literacy: A comparative study at Delhi NCR. Asian Journal of Management, 11(4), 507-516.

- Danes, S. M., and Hira, T. K. (1987). Money management knowledge of college. Journal of Student Financial Aid, 17(1), 1.

- David, L. R. (2010). Financial literacy explicated: the case for a clearer definition in an increasingly complex Economy, Journal of Consumer Affairs - Wiley Online Library, https://doi.org/10.1111/j.1745-6606.2010.01169.x

- Lusardi, A., and Mitchell, O. S. (2011). Financial literacy around the world: an overview. Journal of pension economics and finance, 10(4), 497-508.

- Potrich, A. C. G., Vieira, K. M., and Kirch, G. (2015). Determinants of financial literacy: Analysis of the influence of socioeconomic and demographic variables. Revista Contabilidade & Financas, 26, 362-377.

- Rasoaisi, L., and Kalebe, K. M. (2015). Determinants of financial literacy among the National University of Lesotho students. Asian Economic and Financial Review, 5(9), 1050–1060. https://doi.org/10.18488/journal.aefr/2015.5.9/102.9.1050.1060

- Sandra, J. H. (2010). Measuring financial literacy. Journal of Consumer Affairs. https://doi.org/10.1111/j.1745-6606.2010.01170.x

- Wagner, J. F. (2015). An analysis of the effects of financial education on financial literacy and financial behaviors. The University of Nebraska-Lincoln; https://digitalcommons.unl.edu/businessdiss/50/.

- Williams, O.J. and Satchell, S.E. (2011). Social welfare issues of financial literacy and their implications for regulation. J Regul Econ 40, 1–40 https://doi.org/10.1007/s11149-011-9151-6